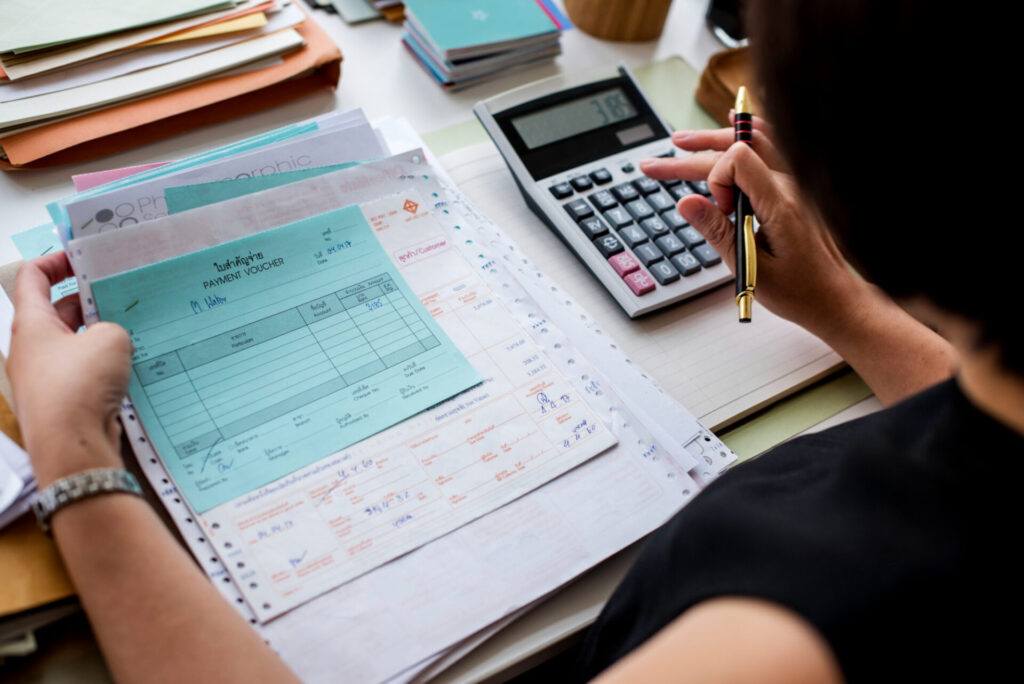

When you’re preparing a business plan—whether it’s for a start-up venture or a growing company looking to secure funding—your financials are where many readers turn first. Why? Because while vision and values set the tone, it’s the numbers that show whether your ideas are feasible, scalable, and investable.

At CABAS, we regularly support entrepreneurs and SMEs in South Africa with building sound, investor-ready business plans. In this blog, we’ll take you through exactly what needs to be included in the financial section of your business plan—and why each component matters.

1. Sales Forecast

Start with your sales forecast, a projection of your expected revenue over a specific period—usually three to five years. This section demonstrates how you anticipate your business will grow and what income you expect to generate.

What to include:

- Monthly projections for at least the first year

- Yearly summaries for the next two to four years

- Breakdown by product or service line

- Seasonal or market variations, if applicable

Why it matters:

It sets the tone for the rest of your financials. Sales projections feed into your cash flow and profit calculations, giving a top-down view of how the business might perform.

2. Expense Budget

Next, detail your operating expenses—everything you’ll need to spend to run your business day-to-day. This section should align with your sales forecast in terms of timeframes and growth.

Typical costs include:

- Rent and utilities

- Salaries and wages

- Inventory and materials

- Marketing and advertising

- Software subscriptions and equipment

- Insurance, professional services, and licences

Why it matters:

Investors and lenders want to see that you understand the cost of doing business and that your operations are sustainable even during lean periods.

Explore our Bookkeeping Services to get expert help managing your operating costs.

3. Cash Flow Projection

Your cash flow statement predicts when money will move in and out of your business. Unlike your profit and loss statement, cash flow looks at actual cash—what hits the bank account and when.

Key elements:

- Inflows: from sales, loans, investments

- Outflows: salaries, rent, repayments, supplier payments

- Net cash position each month

Why it matters:

A profitable business can still run into trouble if cash flow is mismanaged. This projection helps you plan for shortfalls and ensures you won’t be caught off guard.

Need help planning your cash flow? Our Accounting Services provide accurate tracking and forecasting support.

4. Income Statement (Profit & Loss)

The income statement, often called the profit & loss (P&L) statement, gives an overview of revenues, costs, and profits over time.

What it should show:

- Revenue streams

- Direct costs (cost of goods sold)

- Operating expenses

- EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation)

- Net profit or loss

Why it matters:

It summarises how much money your business is making after costs, providing a clear view of its financial health.

5. Balance Sheet Forecast

The balance sheet provides a snapshot of your business’s financial position at a given point. It reflects what you own (assets), what you owe (liabilities), and what’s left over (equity).

Main sections:

- Assets: cash, accounts receivable, inventory, equipment

- Liabilities: loans, accounts payable, tax owed

- Equity: initial investment, retained earnings

Why it matters:

This gives investors and banks a clear idea of your business’s net worth and financial stability. It also shows how efficiently your capital is being used.

6. Break-Even Analysis

A break-even analysis identifies the point at which your revenue will cover all your expenses. In other words, how much you need to sell to avoid losses.

Include:

- Fixed and variable costs

- Break-even volume or value

- A graph for visual clarity (optional but effective)

Why it matters:

It’s a powerful indicator of risk and can help investors assess how much runway your business will need before turning a profit.

7. Assumptions and Methodology

All forecasts should be backed up by a clear explanation of your assumptions. This is where you explain the “why” behind your numbers.

What to clarify:

- Market growth expectations

- Pricing strategy

- Customer acquisition cost

- Seasonality or economic conditions

- Source of figures (past performance, market research, expert estimates)

Why it matters:

This section adds credibility to your plan. Financial projections based on wishful thinking are easily spotted—well-justified assumptions are not only more believable, but more useful to your own decision-making.

Need Help With Your Business Plan Financials?

Preparing accurate and professional financials can feel daunting, especially if numbers aren’t your strong point. That’s where we come in. The CABAS team offers qualified, hands-on support to help you draft a realistic, funder-friendly business plan from start to finish.

From bookkeeping and tax submissions to secretarial services and strategic advice, we ensure your numbers don’t just look good—they hold up under scrutiny.

📞 Let’s Talk Business

Ready to strengthen your business plan with solid financials?

Contact us today or browse our full range of services to see how CABAS can help your business grow.